ICICI Prudential’s Tech Fund is a mutual fund in the technology sector. It aims to provide investors with long-term capital appreciation by investing in companies involved in the development and application of technology. The fund is managed by ICICI Prudential Asset Management Company, one of India’s leading asset management companies.

ICICI Prudential Asset Management Company is a joint venture between ICICI Bank, one of India’s largest private sector banks, and Prudential Plc, a leading international financial services group. The company has a strong track record of managing mutual funds and has been recognized for its expertise in various sectors.

Understanding the technology sector and its potential

The technology sector comprises companies involved in technology research, development, and application. This includes companies in software, hardware, telecommunications, e-commerce, and biotechnology industries. The sector has experienced significant growth in recent years and is expected to continue growing rapidly.

Several factors drive the growth potential of the technology sector. Firstly, technological advancements have increased efficiency and productivity in various industries. Companies constantly seek innovative solutions to improve their operations and gain a competitive edge. This has created opportunities for technology companies to develop and provide products and services that meet these needs.

Another key driver of the sector’s growth is consumers’ increasing adoption of technology. With the proliferation of smartphones and internet connectivity, people increasingly rely on technology for various aspects of their daily lives, such as communication, entertainment, shopping, and banking. This trend will continue as technology becomes more integrated into our society.

Investment strategy and portfolio composition of the Tech Fund

The Tech Fund follows an active investment approach, meaning that the fund manager actively selects stocks based on their market trends and company fundamentals analysis. The fund aims to invest in companies with the potential for long-term growth and leaders in their respective sectors.

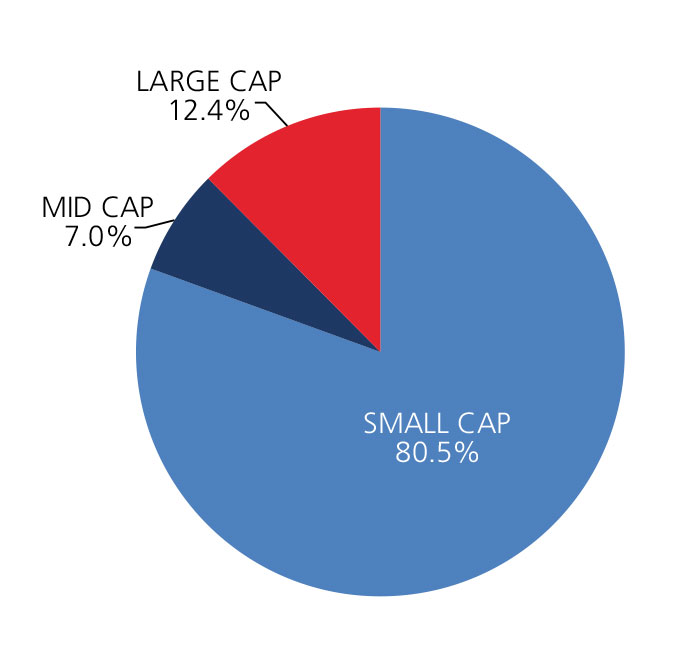

The Tech Fund’s portfolio is diversified across various subsectors within the technology sector. This includes companies involved in software development, hardware manufacturing, telecommunications, e-commerce, and other emerging technologies. The fund manager takes a bottom-up approach to stock selection, focusing on companies with strong fundamentals, competitive advantages, and growth potential.

Diversification is an important aspect of the fund’s investment strategy. By investing in a diversified portfolio of stocks, the fund aims to reduce risk and enhance returns. The fund manager carefully selects stocks from different sub-sectors within the technology sector to ensure the portfolio is well-balanced and not overly concentrated in any particular area.

Performance Analysis of the Tech Fund

The Tech Fund has delivered strong performance since its inception. Over the past five years, it has consistently outperformed its benchmark index, which measures the overall performance of the technology sector. The fund’s performance can be attributed to its active investment approach and the expertise of its fund manager.

When comparing the fund’s returns with benchmark indices, it is important to consider both absolute and risk-adjusted returns. Absolute returns measure the total return generated by the fund, while risk-adjusted returns take into account the level of risk taken by the fund to generate those returns.

Regarding absolute returns, the Tech Fund has consistently delivered above-average returns compared to its benchmark index. This can be attributed to the fund’s focus on high-growth companies within the technology sector. These companies have generated strong earnings growth and created value for shareholders.

When considering risk-adjusted returns, the Tech Fund has also performed well. The fund has generated attractive returns while maintaining a relatively low level of volatility compared to its benchmark index. This indicates that the fund has generated consistent returns without taking excessive risk.

Benefits of investing in ICICI Prudential’s Tech Fund

Investing in ICICI Prudential’s Tech Fund offers several benefits to investors. Firstly, the fund provides the potential for high returns. The technology sector has a track record of delivering above-average returns, and the Tech Fund aims to capture this potential by investing in high-growth companies within the industry.

Secondly, investing in the Tech Fund provides exposure to a high-growth sector. The technology sector is expected to continue growing at a rapid pace, driven by advancements in technology and increasing consumer adoption. Investing in the Tech Fund allows investors to participate in this growth and benefit from the sector’s long-term potential.

Lastly, the Tech Fund is managed by a team of experienced professionals who deeply understand the technology sector. The fund manager conducts thorough research and analysis to identify companies with strong growth potential and competitive advantages. This expertise can help investors make informed investment decisions and navigate the complexities of the technology sector.

Risks associated with investing in the technology sector

While investing in the technology sector offers the potential for high returns, it also comes with certain risks that investors should be aware of. One of the main risks is volatility and market risks. The technology sector is volatile, with stock prices often experiencing sharp fluctuations. This volatility can be attributed to factors such as changes in market sentiment, technological advancements, and regulatory developments.

Another risk is regulatory risks. The technology sector is subject to various regulations and government policies that can impact companies’ operations and profitability. Changes in laws or new regulations can significantly affect the performance of technology companies.

Competition and innovation risks are also important considerations when investing in technology. The sector is highly competitive, with companies constantly striving to develop innovative products and services to gain a competitive edge. This creates a risk that companies may not be able to keep up with the pace of innovation or may face increased competition from new entrants.

How to invest in ICICI Prudential’s Tech Fund

Investing in ICICI Prudential’s Tech Fund is straightforward. Investors can access the fund through various channels, including online platforms, mobile apps, and offline channels such as branches and distributors.

To invest online, investors can visit the ICICI Prudential website or use the mobile app to complete the investment process. They must provide their personal and financial details, select the Tech Fund as their investment option, and specify the amount they wish to invest. Once the investment is made, investors will receive a confirmation, and their units will be allocated.

For offline investments, investors can visit any ICICI Prudential branch or contact a distributor to complete the investment process. They will need to fill out an application form, provide the necessary documents, and make the payment. The units will be allocated once the investment is processed.

The minimum investment requirement for the Tech Fund is Rs. 5,000 for lump sum investments and Rs. 1,000 for systematic investment plans (SIPs). SIPs allow investors to invest a fixed amount at regular intervals, such as monthly or quarterly.

Expert opinions and reviews on the Tech Fund

ICICI Prudential’s Tech Fund has received positive reviews from industry experts and rating agencies. The fund has been recognized for its strong performance and expertise in the technology sector.

Industry experts have praised the fund manager’s ability to identify high-growth companies within the technology sector. They have also highlighted the fund’s consistent performance and ability to generate attractive returns while managing risk effectively.

Rating agencies have also given favorable ratings to the Tech Fund. These ratings consider various factors such as historical performance, risk management, and fund manager expertise. The ratings provide investors with an independent assessment of the fund’s quality and potential for future performance.

Existing investors in the Tech Fund have also provided positive feedback. They have highlighted the fund’s ability to deliver consistent returns and its focus on high-growth companies within the technology sector. Investors have also appreciated the professional management of the fund and the ease of investing through various channels.

The future outlook for the technology sector and the Tech Fund

The technology sector is expected to continue growing rapidly in the coming years. Advancements in technology, increasing consumer adoption, and emerging trends such as artificial intelligence, cloud computing, and the Internet of Things are expected to drive growth in the sector.

The Tech Fund aims to capitalize on this growth by investing in well-positioned companies that can benefit from these trends. The fund manager will continue to focus on identifying high-growth companies within the technology sector and actively managing the portfolio to generate attractive returns for investors.

Frequently asked questions about ICICI Prudential’s Tech Fund.

1. What is the minimum investment requirement for ICICI Prudential’s Tech Fund?

The minimum investment requirement for lump sum investments is Rs. 5,000, while for systematic investment plans (SIPs), it is Rs. 1,000.

2. How can I invest in ICICI Prudential’s Tech Fund?

Investors can invest in the Tech Fund through various channels, including online platforms, mobile apps, and offline channels such as branches and distributors.

3. What are the risks associated with investing in the technology sector?

The technology sector is subject to volatility, market, regulatory, competition, and innovation risks.

4. How is the Tech Fund’s performance compared to benchmark indices?

The Tech Fund has consistently outperformed its benchmark index over the past five years, delivering above-average returns.

5. What are the benefits of investing in ICICI Prudential’s Tech Fund?

Investing in the Tech Fund offers the potential for high returns, exposure to a high-growth sector, and professional fund management.

For further information about ICICI Prudential’s Tech Fund, investors can visit the company’s website or contact their customer service.